Fact Sheet: Mayor’s 2018 Budget Proposal

Seattle Retirement Savings Plan

Mayor Burgess’ 2018 Proposed Budget includes legislation that lays out the path to establishing a Seattle Retirement Savings Plan (SRSP) that will provide Seattle workers with an efficient and cost-effective way to save for retirement for those whose employers that do not offer a workplace retirement savings plan. As part of this initiative, the Mayor’s proposed budget includes $200,000 to conduct a market feasibility study and legal analysis of the SRSP.

The SRSP will be comparable to a defined contribution structure — like a 401(k) or 403(b) — where employees contribute to their own separate account and are responsible for selecting investments from professionally-managed product options available in the SRSP. Employees will grow their retirement savings through additional contributions and investment performance. Accounts will be portable and remain with the worker if they change employers. Employers would perform a limited administrative function by processing payments of eligible employees to the third-party private administrator through their existing payroll system.

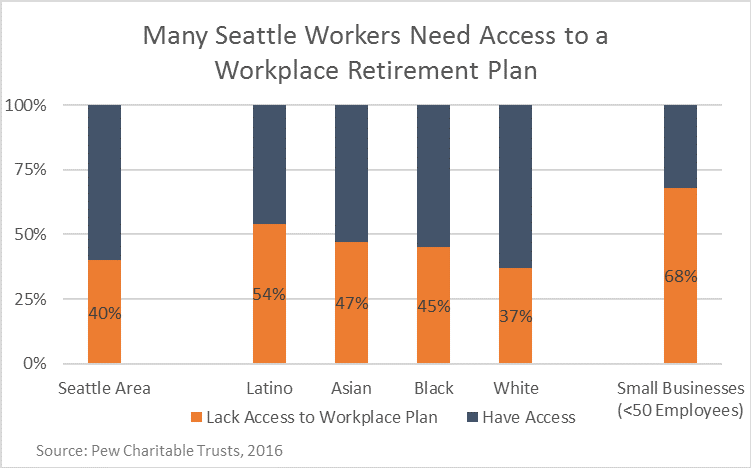

Individuals are far more likely to save for retirement if an option is made available to them in their workplace, especially if they are automatically enrolled into a plan. Unfortunately, Pew Charitable Trusts found in 2016 that 40% of employees in the Seattle metro area do not have access to a workplace retirement savings plan. Applying this figure to the city, an estimated 200,000 Seattle workers lack access to a workplace retirement savings plan. People of color are particularly disadvantaged with 45% of black workers, 54% of Latino workers, and 47% of Asian workers lacking access to a workplace plan, compared to 37% of white workers. The situation is especially grim for employees of small businesses where 68% of those at firms under 50 employees lack access to a workplace plan.